ATTENTION: NEW and experienced property owners

Your Shortcut to Homeownership & Property Investing — Made Simple

Every Day You Wait Is Money Lost—Take Control of Your Wealth

CLICK BELOW TO WATCH FIRST!

Next Step: Get Matched With A Lending Advisor By Answering a Few Questions...

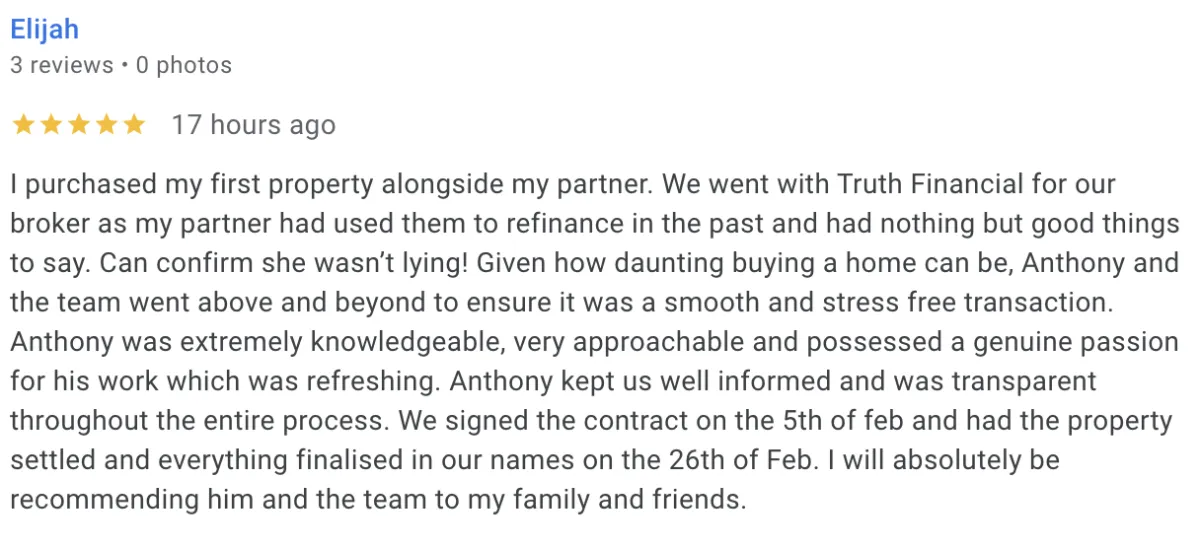

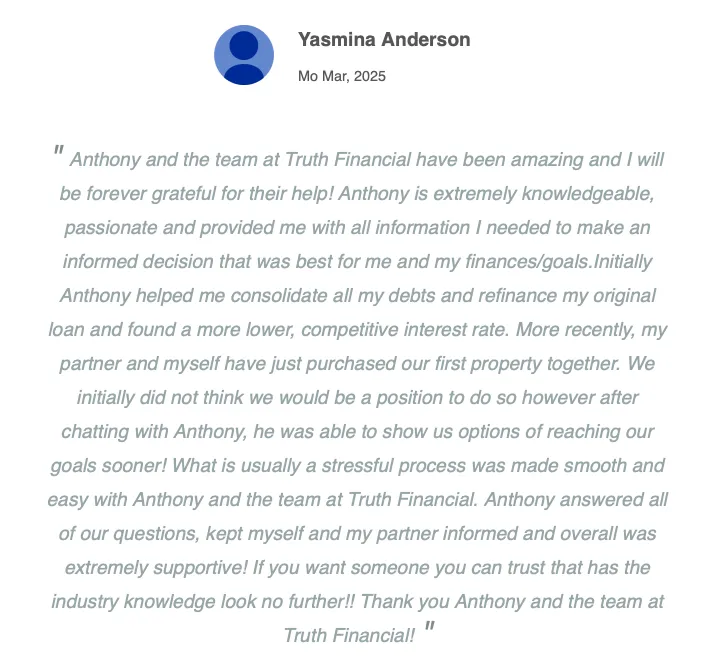

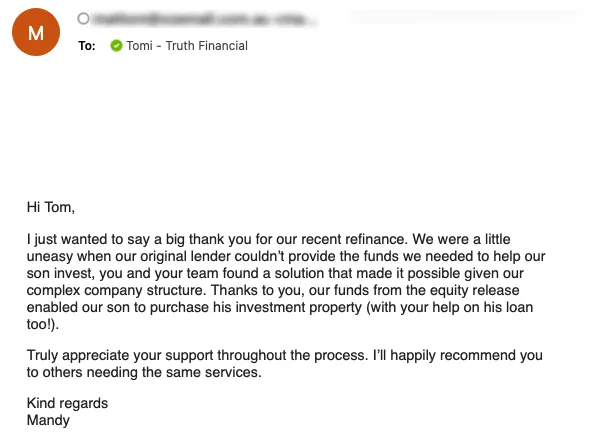

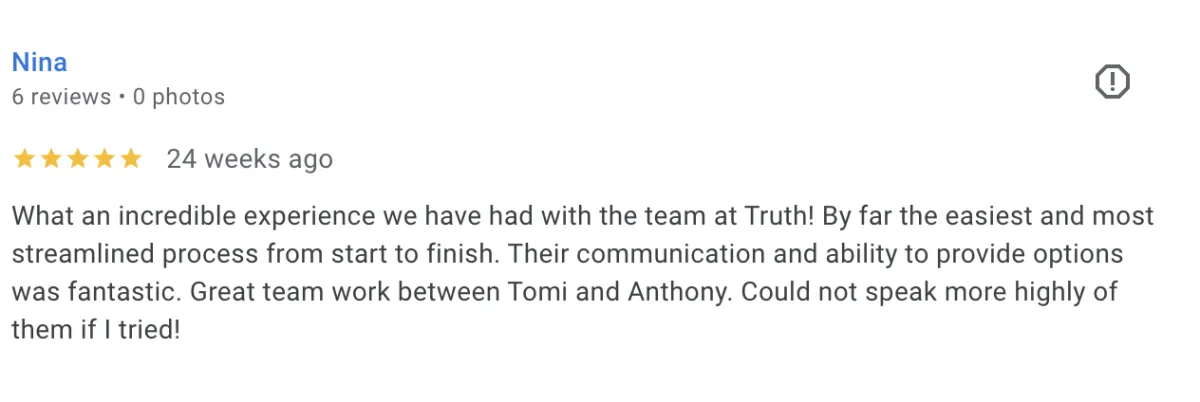

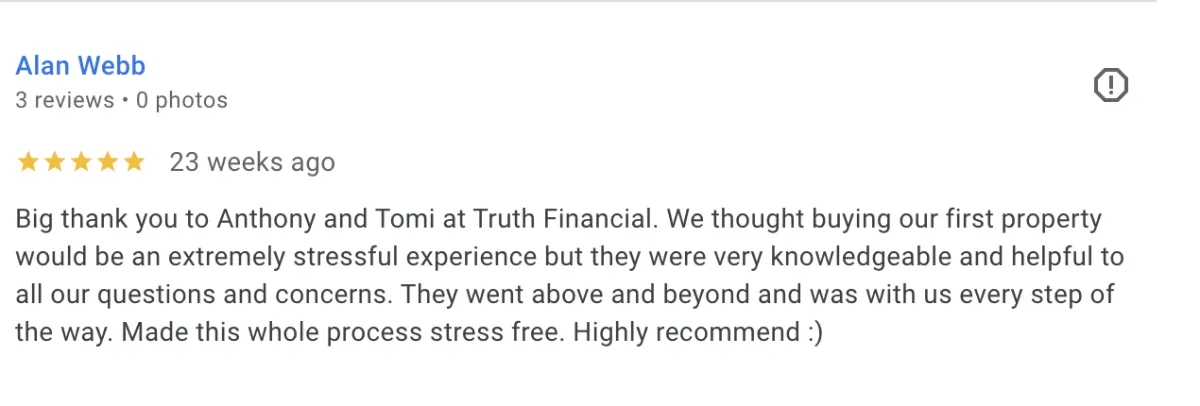

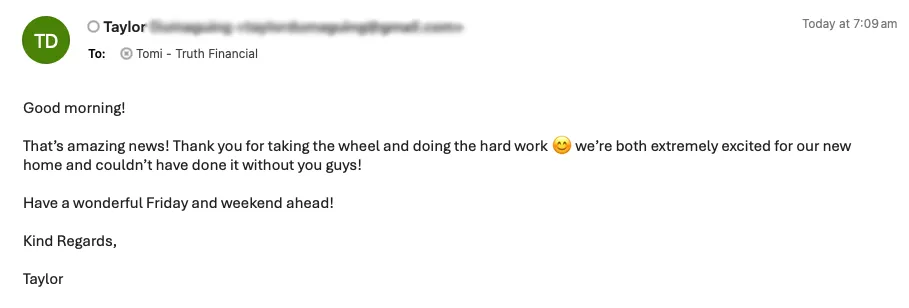

TESTIMONIALS

See what others are saying

For Australians Looking to Invest or Own Property, and Need Expert Guidance

(No matter how new or experienced you are)

For example...

Property Investors

SMSF Lending

Refinancing

First Home Buyers

Fast Loan Approvals

Personalised Loan Solutions

STILL NOT SURE?

Frequently Asked Questions

Here's what we usually get asked

So how does it work?

We make securing a loan simple. First, we’ll chat to understand your goals and financial situation. Then, we’ll assess your options across over 50+ available lenders to find the best loan for you. Once you’re pre-approved (or fully approved), we’ll guide you through the application process, all the way to settlement, and provide ongoing support to help you build wealth for the future.

What types of loans do you offer?

We offer a variety of loan products tailored to your needs, including home loans, investment loans, refinancing options, and SMSF loans. Whether you’re a first-time homebuyer or an experienced property investor, we’ve got the right solution for you.

What documents do I need to apply for a mortgage?

Typically, you’ll need to provide proof of income, bank statements, identification, and information about your debts and assets. Our team will guide you on the specific documents required for your application.

How long does the mortgage approval process take?

The mortgage approval process can vary based on several factors, including the type of loan and your financial situation. Generally, it can take anywhere from a few days to several weeks. We strive to make the process as quick and efficient as possible.

What costs are involved in getting a loan?

In addition to your deposit, you’ll need to budget for costs such as stamp duty, lender fees, and legal fees. We’ll break down all the costs upfront so you know exactly what to expect and give you confidence in your decision.

Do I need a property picked out before applying?

Not at all! You can get pre-approved for a loan first, so you know your budget before house-hunting. This makes the process smoother and gives you confidence when making offers.

Can I get help if I’m a first-time homebuyer?

Absolutely! We specialise in guiding first-time homebuyers through the process, from understanding your options to accessing government grants and low deposit loans. We're here to make your dream home a reality.

What if I'm not sure what to do with my current situation?

It’s common to feel unsure about your options, especially when it comes to property and finance. After a quick chat and diving into your financial details, we’ll identify opportunities you might not even know are available. Whether it’s buying your first home, refinancing, or unlocking investment potential, we’ll find the right path for you based on your unique situation.

Can I Use My Superannuation to Invest in Property?

Using your Self-Managed Super Fund (SMSF) to invest in property can be a smart way to build wealth for retirement. We’ll help you navigate the complexities of SMSF lending, ensuring you understand the requirements and identify the best investment opportunities for your super. With our expert guidance, you can make the most of your SMSF to secure your financial future.

What if I cant find a property?

If you’re struggling to find the right property, don’t worry, we’ve got you covered. Through our network of trusted partners, we have access to both on-market and off-market deals that aren’t always available to the public. If you need assistance, we can open the lines of communication and connect you to these opportunities, helping you find the perfect property.

How We Get You Into Your Dream Home (or Investment Property)

Step 1

Ready to take the next step? Click the "Apply" button below and get in touch with us. We'll listen to your goals and start creating a clear plan to make them a reality.

Step 2

We’ll assess your financial situation and find the best loan options tailored specifically to your needs, ensuring that you get the best rates, terms, and conditions to achieve your property goals.

Step 3

Whether it’s your first home or an investment property, we’ll be there to guide you from pre-approval to settlement, ensuring the process is smooth, quick, and stress-free. And when you hold those keys in your hand, we’ll be there to congratulate you on your new home or investment.

Ready to get started?

MEET THE FOUNDERs of truth

Hey, we're Tomi & Anthony

We’re first cousins driven by one mission: to dominate the finance industry through our clients' success. We deliver loan solutions that redefine the market, offering exclusive financing options designed with your success in mind.

Found a better offer? We'll challenge that.

Successfully assisted clients in securing their home loans with a 98% approval rate.

Consistently delivering exclusive loan solutions that leverage our in-depth industry knowledge, offering options unique to us.

Built a reputation for delivering fast and efficient approvals, reducing clients’ waiting times by up to 60%.

Providing our clients access to off-market deals through our extensive network of industry partners.